In-Ovo Sexing

In-ovo sexing is an innovative new technology where the sex of a chicken egg can be determined while it’s still developing. This allows egg producers to hatch only females, providing an alternative to the culling of day-old male chicks.

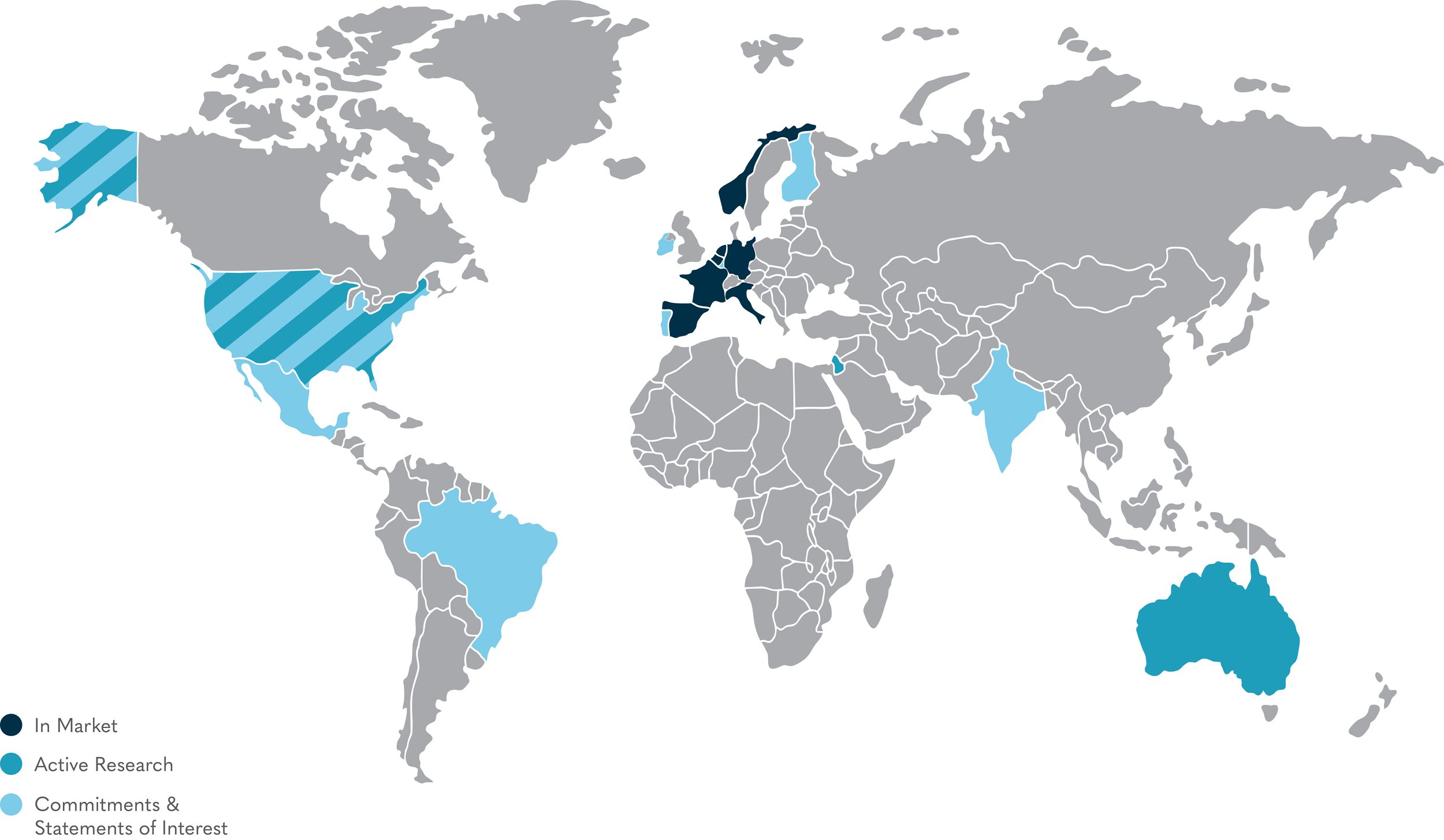

The technology has advanced rapidly over the last few years, and is now widely available in Europe and expected in the US market in 2025. In-ovo sexing companies are racing to scale up the technology to meet this increase in global demand.

Male Chick Culling

Industrialization in the poultry sector has led to a bifurcation of the breeds we use for meat and eggs. “Broiler” chickens used for meat are optimized to grow quickly and efficiently convert feed to meat. “Layer” chickens used for eggs are optimized to lay eggs as quickly and efficiently as possible. This division of labor is why chicken meat and eggs are so affordable today. However, one unintended consequence is that male chicks of the layer breed serve no economic purpose, and are killed immediately after hatching. In a practice that’s extremely unpopular among consumers that know about it, 6 billion day-old male chicks are killed each year in the global egg industry, usually via live maceration (they are cut into pieces alive).

To solve this problem, innovators in Europe and around the world are developing in-ovo sexing technology, which allows egg producers to use advanced biotechnology to identify which eggs will hatch male and which will hatch female. Male eggs are removed and destroyed during the incubation process before they can feel pain. These male eggs can be turned into a protein powder and incorporated into pet feed. Only the female eggs are returned to the incubator to hatch, solving the ethical problem of male chick culling.

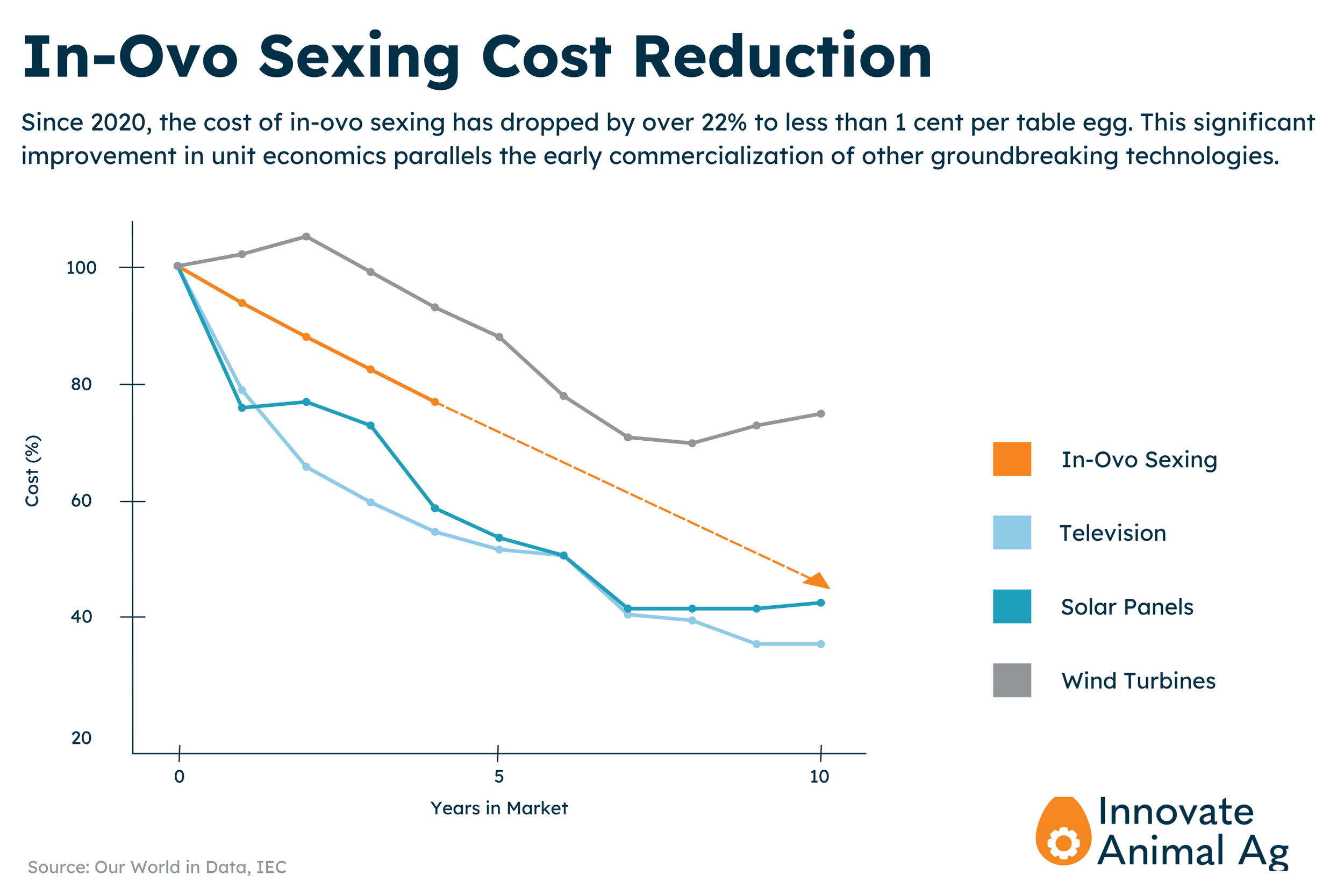

This technology, which is now widely available in Europe, is more expensive right now (1-3 cents per egg at the supermarket). But as the technology improves, and as economies of scale are reached, costs will fall. In the long term, the economics of automation imply it will be cheaper than the status quo of paying humans to identify the gender of every chick by hand. In-ovo sexing also unlocks other efficiencies for hatcheries like freeing up incubator space that would have been taken up by male eggs, or enabling other technologies like on-farm hatching or in-ovo vaccination, that were previously impracticable due to the necessity of post-hatch sex sorting.

Current Commercial Status

European Union - Over the last few years, in-ovo sexing technology has become widely available in Europe, spurred by bans in Germany, France, and Italy on the practice of male chick culling. Original research by Innovate Animal Ag indicates that, as of September 2023, at least 56.4 million of the current layer population of 389 million hens in the European Union were sexed in-ovo. This indicates a 15% market penetration after only 5 years. That number is growing quickly as more hatcheries implement the technology, the capacity of existing machines is increased, and further R&D improves the efficiency of the technology. In the three months after they 15% figure was generated, in-ovo sexing saw a 23% increase in global capacity in a single quarter. In-ovo sexed hens cost around €2.60 more than conventional hens, or around 0.75 euro centsper table egg. These table eggs then retail for 1-3 cents more per table egg (12-36 cents per dozen).

United States - In-ovo sexing will be available in the US in early 2025 according to an egg producer who announced the introduction of the technology to the US in the New York Times. Once a machine is on US soil, it is likely that in-ovo sexing will expand in the US market quickly given many stakeholders, including The United Egg Producers, Vital Farms, and Unilever, have expressed interest in the technology. Unlike the EU, adoption of the technology in the US will be driven by the market, rather than by government bans. Like many innovative technologies, we will see initial adoption in the high-welfare specialty part of the market, where consumers have already shown a willingness to pay a small price premium for better animal welfare. Over time, cost reduction will be key to broader adoption. Read more about the potential path to market in the US here.

Globally - While in-ovo sexing is currently concentrated in Europe, the technology is garnering interest globally. This includes commitments from state governments in India, industry commitments in Mexico, Brazil, and Chile, investments in R&D from the Australian and Japanese governments, and multiple startups in Israel developing the technology.

Technology

There are multiple technological approaches to egg sexing, each with pros and cons, and each at various stages of commercialization.

In-ovo sexing is implemented at the hatchery stage of the egg supply chain. In a hatchery, fertilized eggs develop inside an incubator. When the eggs are ready to be sexed, they’re removed from the incubator and run through a circuit where the male eggs are removed and processed into a byproduct like animal feed. The female eggs are then returned to the incubator to complete their development. The female eggs that are hatched are then sold to egg producers and to be raised in the same way they are now.

In-Market Egg-Sexing Solutions

Two broad approaches have already been introduced to the market in Europe. Within each of these approaches, there could be many ways to implement the technology, which have further pros and cons.

A) Non-Invasive Imaging

Non-invasive imaging technology finds a way to look “through” the shell of the egg to determine the sex of the embryo inside. Agri-AT, the current market leader with 9 operational machines in 7 hatcheries, uses hyperspectral imaging to determine the color of the embryo’s feathers. This only works for brown layers, since males and females have different colored feathers. This solution therefore has limited applications for markets like the US where most layers are white. Another company, Orbem, combines AI with MRI for an imaging solution that works for both brown and white layers. A benefit of this class of technologies is that they don’t require significant consumables, potentially allowing them to be cheaper than other options.

B) Liquid-Based Analysis

Liquid-Based Analysis technologies involve making a tiny hole in the egg shell, taking a fluid sample from inside the egg, and then running a chemical or biological analysis to determine the sex. This process can be highly automated to be able to handle the capacity of the largest hatcheries. There are three companies with commercialized solutions, Respeggt, In Ovo, and PLANTegg, whose technologies vary along a number of important metrics, such as the type of analysis used.

Other Solutions in Development

A number of other technologies are in early trials, aiming to be able to provide accurate, affordable, and safe sexing solutions to hatcheries at the earliest possible day of incubation.

A) Non-Invasive Imaging

Omegga, a German-based startup, is developing a non-invasive technology where an imaging machine is installed directly inside the incubator where the eggs are developing. Rather than removing the eggs from the incubator when they’re ready to be sexed, the imaging machine captures spectroscopic images over the course of multiple days. By taking multiple images of the same egg as it develops, Omegga’s technology could potentially work much earlier in the development process. It also eliminates the need to remove the eggs from the incubator to be sexed.

C) Supported by Gene Editing

Gene editing can be used to give male embryos a genetic marker that allows them to be easily identified and removed, or to stop growing entirely. Importantly, clever breeding strategies make it so that only the males to carry the edited genetic trait. Neither the females nor the table eggs they lay are genetically modified.

Gene editing based solutions will require substantial up-front work to integrate the genetic changes into commercial layer breeds, which are highly optimized and tightly controlled. However, once implemented, they could potentially be extremely cheap and accurate, and work as soon as the egg is fertilized. It remains to be seen whether consumers would have concerns about using gene editing in this way, even though the eggs they eat would carry no genetic changes.

D) Volatile Analysis

Eggs naturally give off some odor via molecules that are able to escape through the egg shell, called volatiles. Innovative labs around the world are pursuing technology that can sex eggs by “smelling” these odors. Egg production lines generally already use vacuum suction cups to move eggs around, allowing this technology to potentially integrate easily into existing infrastructure.

E) Spectroscopic Imaging

In this class of technology, a small hole is made in the egg shell to allow for an optical image to be taken of the embryo inside. These imaging technologies will be more complex and expensive than their non-invasive counterparts, but would work at a very early stage of incubation.

F) Sex Reversal

In poultry, sex can be controlled by factors outside of genetics. Israeli startup SOOS has an AI-driven incubation protocol which controls humidity, temperature, and sound vibrations to cause embryos that are genetically male to develop as phenotypically females. They’ve demonstrated the ability to hatch females at a rate of 65%, with 11% of those having a male genotype.

Challenges

It is yet to be determined which solutions producers and consumers in the US will prefer. However, there are a number of important metrics on which technologies will be evaluated:

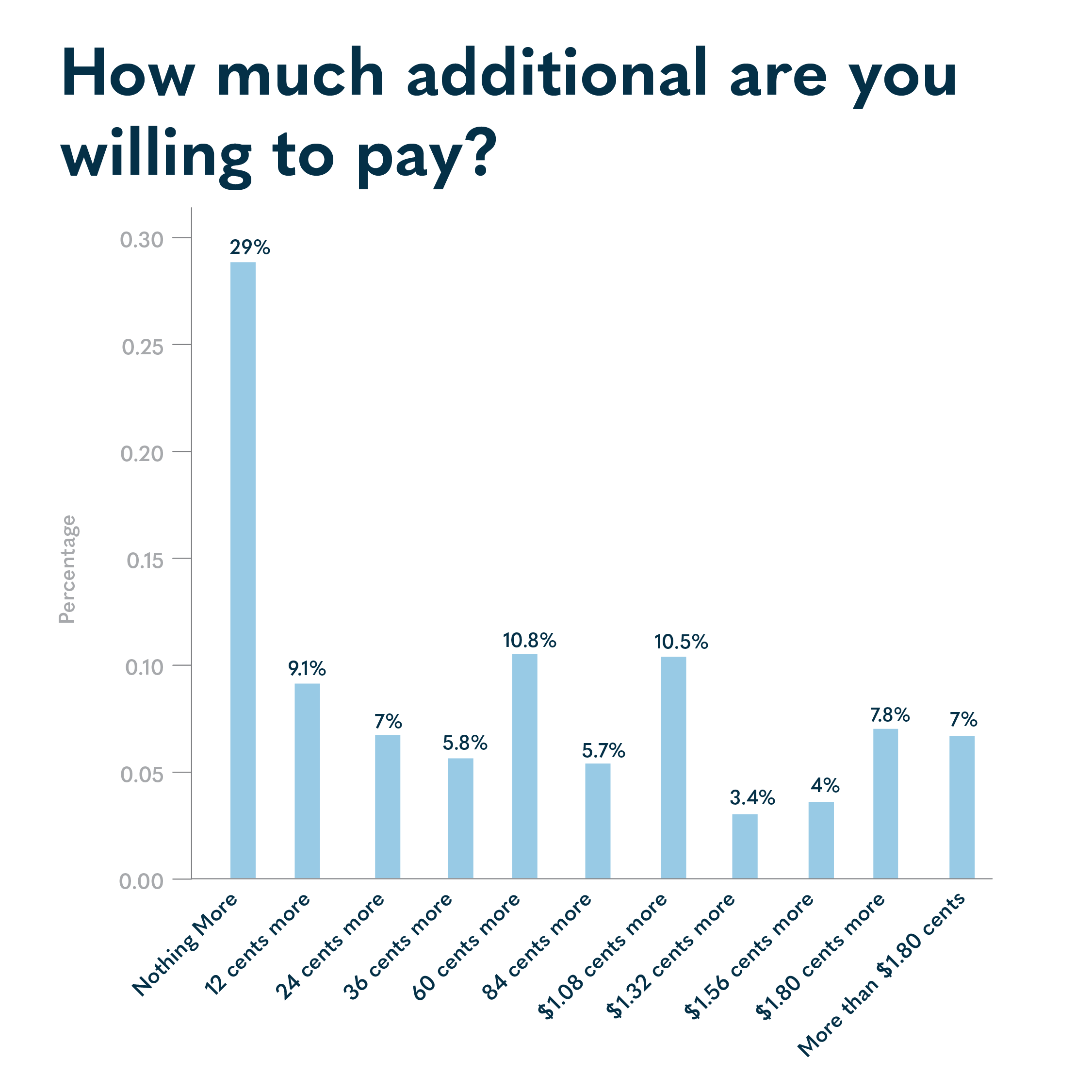

Price: Egg consumers are known for being particularly price sensitive. In the US, in-ovo sexing will likely initially be used for eggs which already carry a price premium for being high welfare (e.g. pasture raised, free range, organic), but minimizing the additional cost will remain important. Notably, the retail price impact of 12-36 euro cents seen in Europe is less than the price premium for cage-free eggs in the US, which fluctuate around $1 per dozen and account for over one third of the US market.

Throughput and speed: According to in-ovo sexing company In Ovo, there are around 500 commercial hatcheries in the world. These hatcheries need to create large numbers of layers very quickly, to supply the roughly 4 billion layers that are needed to meet global egg demand each year. For every layer, at least two eggs need to be sexed (a male and a female). In-ovo sexing technology needs to have a high enough throughput and speed to keep up with this production. That said, current technologies are fairly modular, meaning that a hatchery doesn’t need to convert their entire operation at one time. It’s likely that the first hatcheries in the US to implement this technology will sell both in-ovo sexed and conventional layers.

Day of incubation: In-ovo sexing companies have a goal of being able to sex eggs as early on into the 21-day incubation process as possible. This is partially to minimize the economic burden on hatcheries: the earlier that male eggs can be removed, the more free incubator space the hatchery will reclaim. There is also an animal welfare consideration: a study by the German government indicates that after day 13, pain perception can’t be ruled out. Therefore, in-ovo sexing should ideally work before this cutoff point.

Accuracy: Current manual sexing methods typically work with around 98.5% accuracy, meaning that in-ovo sexing should ideally be equally or more accurate.

Consumers

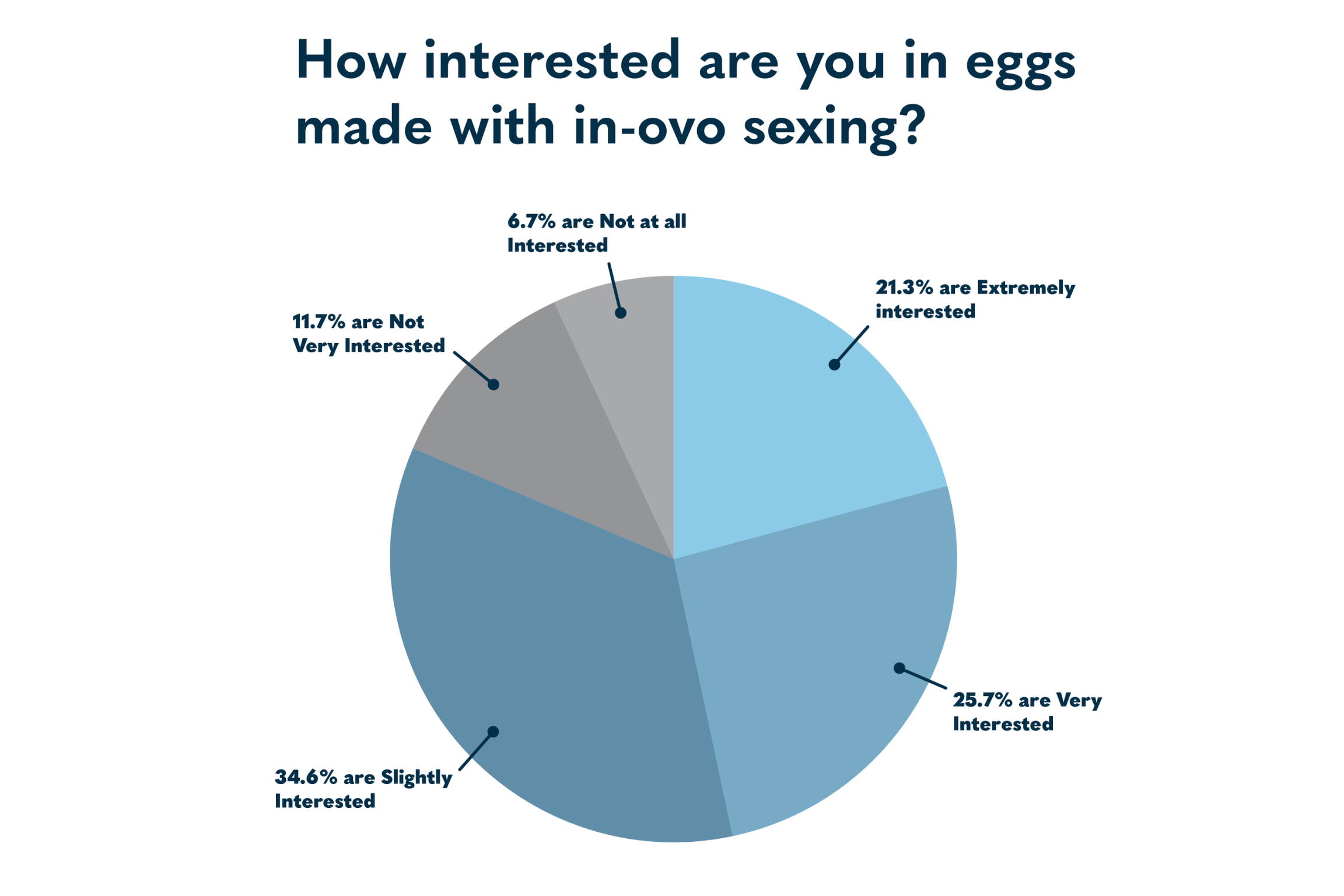

Consumer research on in-ovo sexing generally shows that consumers have low awareness of chick culling and in-ovo sexing, but once informed are extremely interested in seeing the technology implemented.

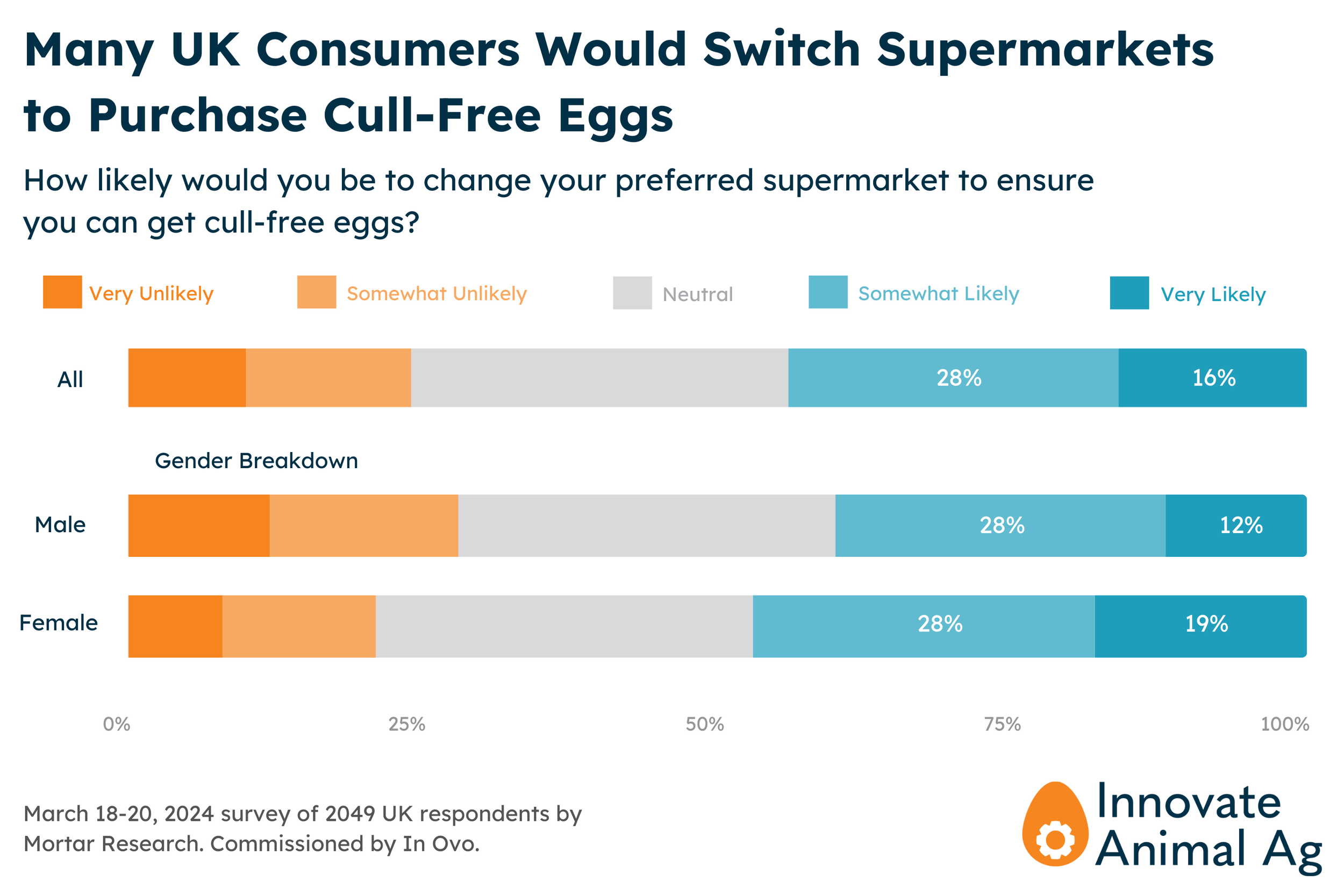

For example, a major face-to-face study of 26,000 citizens in the EU found that 75% of European citizens consider the practice of chick culling unacceptable, and that majorities in 20 EU countries agree that male chicks should not be killed even if it leads to an increase in the price of eggs. This is consistent with another study of German consumers where 89% supported finding an alternative to chick culling, and many were willing to pay multiple euros more for a box of 10 eggs. In the UK, 82% of consumers express that they were uncomfortable with the practice of chick culling. In Chile, two-thirds of respondents agreed that the egg industry should take the initiative to invest in in-ovo sexing technologies without waiting for any legal mandate.

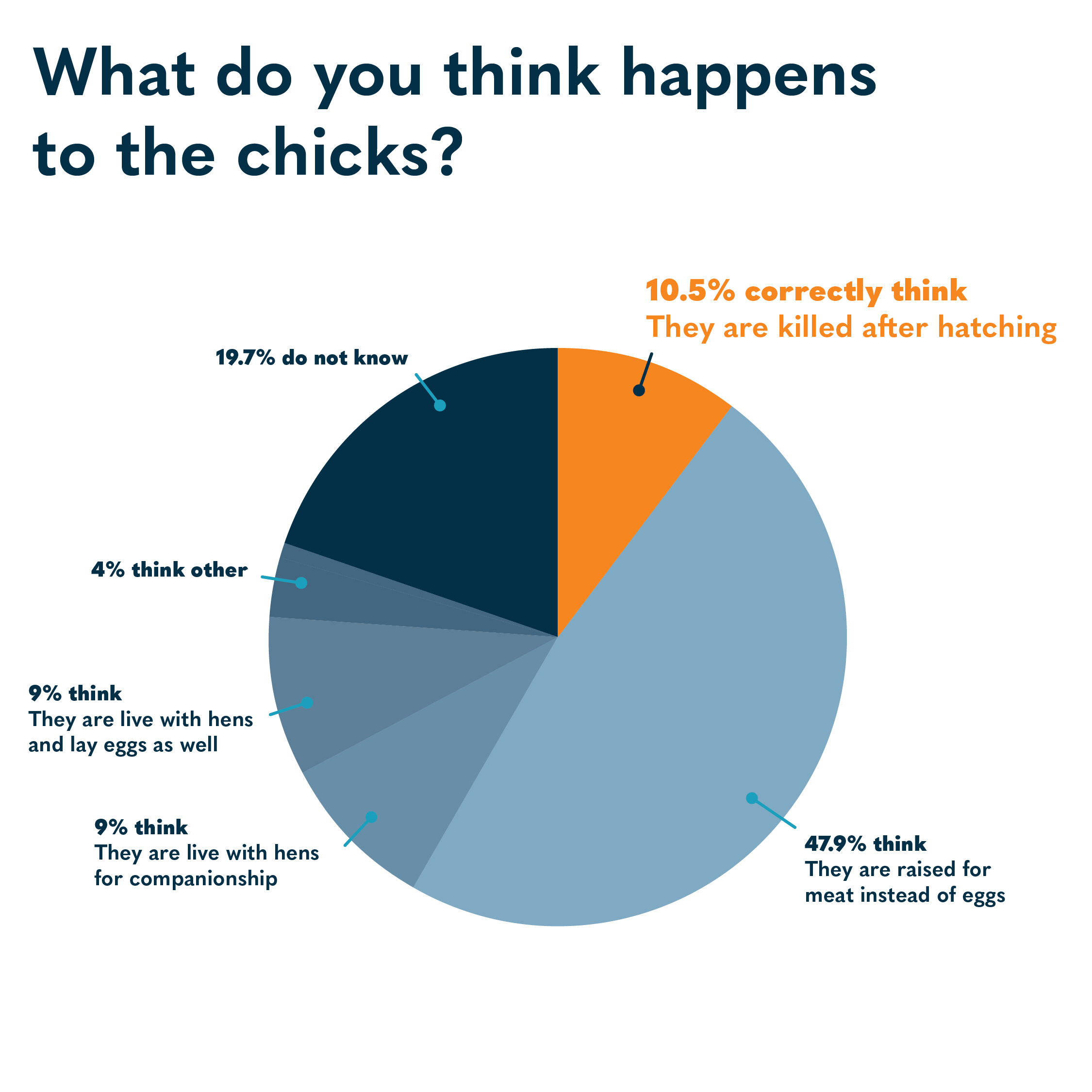

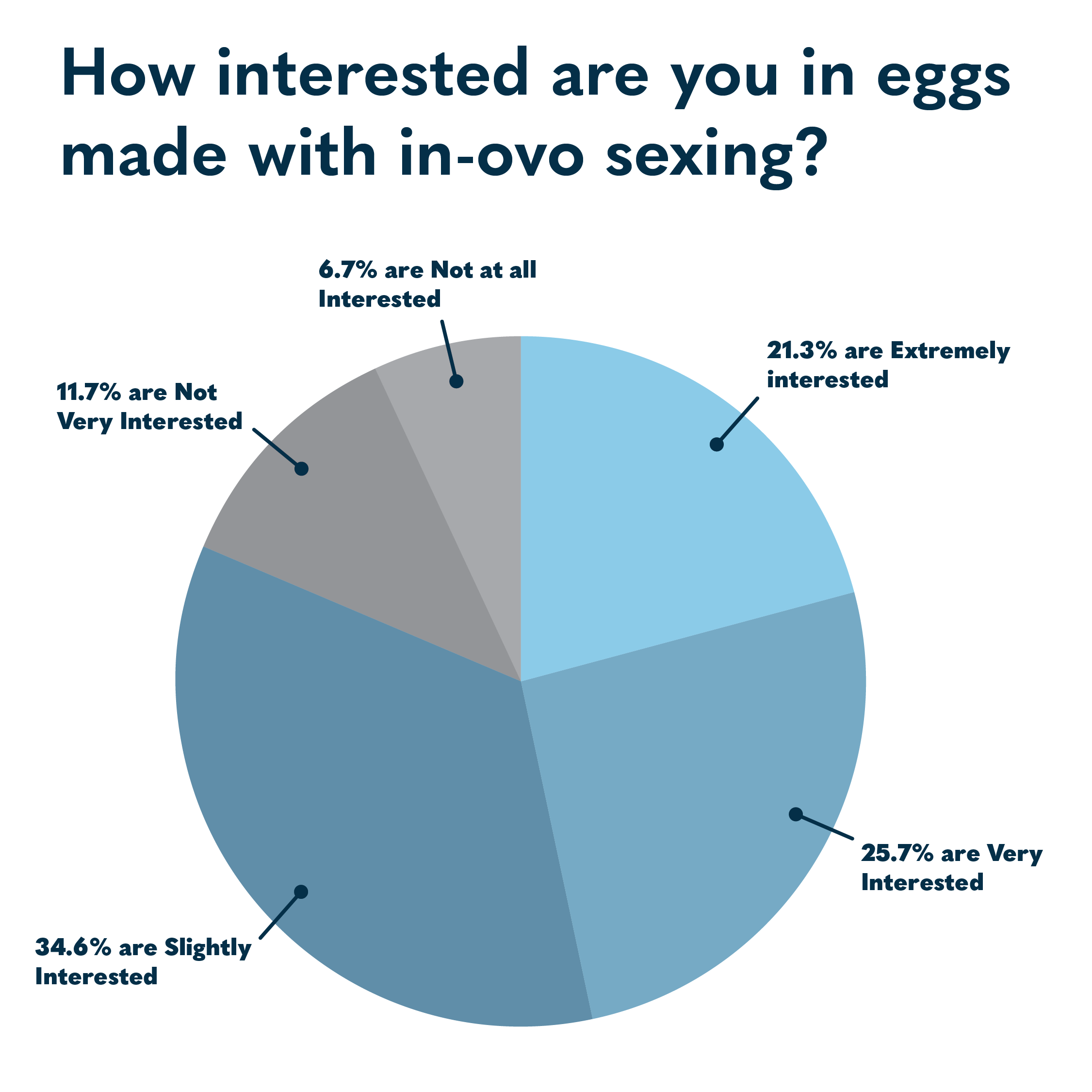

In the United States, original research commissioned by Innovate Animal Ag showed strong consumer interest in eggs made with in-ovo sexing. According to the survey, only 11% of U.S. egg purchasers know about male chick culling, and 48% think male chicks are raised for meat. 47% of consumers (about 122 million U.S. adults) are “extremely” or “very” interested in eggs produced using in-ovo sexing; another 35% (91 million) are “slightly” interested. 71% of egg buyers are willing to pay a price premium, with the median willingness to pay being just over 36 cents per dozen. This data shows that producers who adopt the technology will find a consumer base ready to pay more for it.

Frequently Asked Questions

-

Currently, male chicks are treated as a byproduct of hatcheries, and are generally processed into animal feed, not for human consumption. In some cases, whole chicks are sold as feed for snakes or other exotic animals. With in-ovo sexing, fertilized male eggs are also treated as a byproduct. They can be similarly processed into animal feed, or sold for applications in vaccines or biogas production.

-

Since in-ovo sexing only exists in Europe, it’s impossible to know for sure how expensive eggs made in this way will be to producers in other countries. Data from the European market suggests that table eggs made without culling cost less than a cent additional to produce. These eggs are thenare sold for 1-3 cents additional (12-36 cents more per dozen), which includes the increased margins from the producer and retailer. This price premium is lower than the price premium for cage-free eggs in the US, which generally fluctuates around $1 per dozen.

The increased cost per bird that egg producers would have to pay is estimated at €1.20-3.30 per bird.

-

Eggs are kept inside an incubator for 21 days while they are developing. The power needed to maintain the temperature and environment inside these incubators is an important part of the carbon footprint of egg production. By substantially reducing the number of eggs that need to be incubated, egg producers can save power and increase the sustainability of their production process.

Other alternatives to male chick culling are raising males for meat, or using “dual-purpose” breeds that are bred for both meat and egg production. However, given that these chickens require substantially more feed to produce the same amount of meat, it’s clear that in-ovo sexing is the only sustainable alternative to male chick culling.

-

Male rearing is another possible solution to the problem of chick culling. However, the breeds of chickens used for eggs and meat production have been optimized over decades for their specific purposes, which is how eggs and chicken are so cheap. Therefore, the meat from these male chicks needs to be sold at a loss. Long term, in-ovo sexing is the most economical solution to the problem of male chick culling.

-

In the US, many are concerned about consolidation in the egg industry, where smaller producers struggle to remain competitive in the market. However, both small and large egg producers tend to buy hens from the same hatcheries. Therefore, once in-ovo sexing is implemented, sexed hens will likely be available to both large and small egg producers alike.

-

There is not yet consensus on what to call table eggs from sexed hens in the US. In Europe, eggs made with in-ovo sexing are labeled as “Free of Chick Culling.” In a survey conducted by Innovate Animal Ag, “no-kill” was the best performing term, harkening to no-kill animal shelters. However, there are many considerations producers must take into consideration when deciding on which term will be used for eggs made in this way. It remains to be seen which term will become prominent in the market.

Further Reading

Get Involved

If you’re interested in staying up to date on the technology and commercial status of in-ovo sexing, sign up for our mailing list below.

If you’re an egg producer, or other stakeholder in the US egg supply chain, we can help you understand where you fit in. Don’t hesitate to reach out.