In-Ovo Sexing American Consumer Survey

Innovate Animal Ag commissioned an original consumer survey showing that there is a strong consumer demand for in-ovo sexing technology, and producers that adopt the technology will find a consumer base ready to pay more for it. The survey consisted of 1,012 U.S. egg buyers, each of whom was responsible for purchasing at least 50% of the groceries for their household. It was fielded by Nielsen Consumer Insights from June 24 to July 2, 2023.

According to the survey:

47% of all consumers (about 122 million U.S. adults) are “extremely” or “very” interested in eggs produced using in-ovo sexing; another 35% (91 million) are “slightly” interested. When restricted to the most frequent egg buyers, 73% are “extremely” or “very” interested.

61% of egg buyers are uncomfortable with the practice of “killing” male chicks while 21% are comfortable; 73% agree the egg industry should find an alternative.

81% of egg buyers are unaware of in-ovo egg sexing technology, but 64% agree the egg industry should adopt it instead of culling male chicks.

11% of U.S. consumers know about male chick culling; 48% think male chicks are raised for meat.

The term “no-kill” clearly performed better than other potential terms for in-ovo egg sexing; terms including “cull” fell in the middle and terms including “sex” ranking lowest.

The Business Case

While there can be challenges extrapolating from self-reported willingness-to-pay surveys, these data indicate a strong business case in the immediate term for eggs made with in-ovo sexing.

71% of egg buyers are willing to pay a premium for eggs produced using in-ovo sexing.

Around half of consumers are willing to pay a premium of 60 cents or more per dozen for eggs produced without chick culling.

Comparison to Cage-Free

The retail price premium for cage-free eggs in the US fluctuates around $1 per dozen, substantially more than the 12 - 36 cent premium for in-ovo sexing seen in Europe. Yet, consumers find the practice of chick culling more unacceptable than keeping hens in battery cages. This suggests a new segment of eggs produced without chick culling could be at least as successful in the market as cage-free eggs, which represent 34% of the United States’ $15B market. For brands that command a price premium for higher welfare, in-ovo sexing could therefore be a highly cost-effective investment compared to other welfare labels.

The first producers to implement the technology will be able to pass the increased cost directly to the consumer. Since in-ovo sexing is not yet available in the US, the early adopters will have a strong differentiator allowing them to charge higher margins and increase their profitability.

International Consumer Data

Piecing together international insights from consumer surveys, a clear trend emerges. From Santiago to Stuttgart, and London to Los Angeles, consumers are echoing the same sentiment: the traditional practice of male chick culling is untenable. More significantly, the public isn’t merely expressing disapproval, but rather voicing their readiness to embrace in-ovo sexing technology and even bear costs associated with its adoption. Egg producers with an eye towards the future should recognize that beyond the ethical considerations, meeting this demand is an opportunity to move into a higher margin specialty segment.

Europe

The European Commission surveyed an impressive 26,000 citizens of the European Union’s 27 member states. Over a period of a month, researchers spoke with these citizens face to face and asked them their opinion on a number of animal welfare related topics. The study found that 75% of European citizens consider the practice of chick culling unacceptable, and that majorities in 20 of the member states think that male baby chicks should not be killed even if it leads to an increase in the price of eggs.

This is consistent with another study of German consumers where 89% supported finding an alternative to chick culling, and many were willing to pay multiple euros more for a box of 10 eggs. Polling group Sova Harris also ran a representative survey of 1500 Bulgarian citizens on the topic of animal welfare. They found that among Bulgarians, 92% of citizens found the practice of chick culling unacceptable and wished that the industry adopt in-ovo sexing.

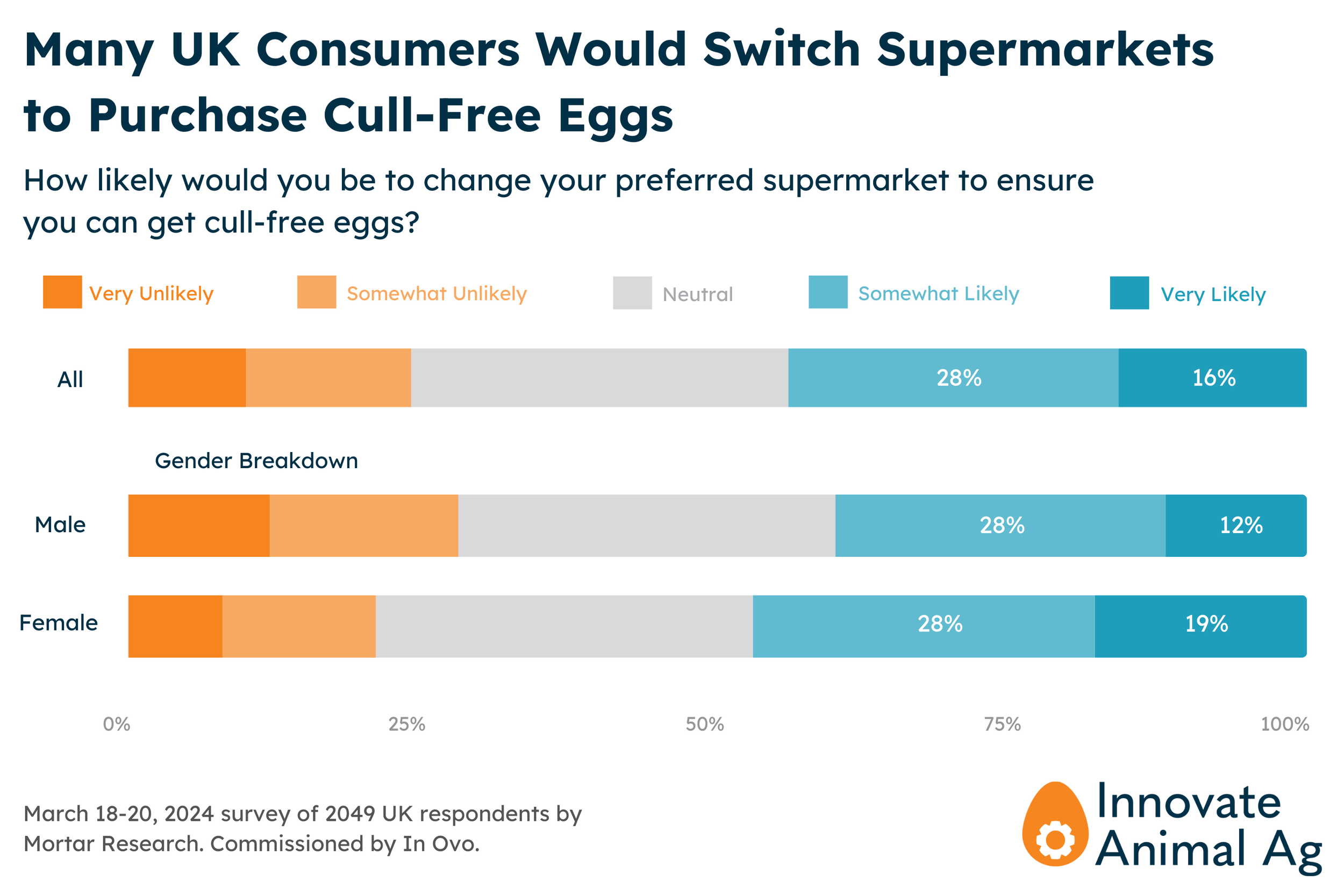

Across the channel in the UK, another representative study of 1,000 consumers by Bryant Research also found the practice of chick culling to be widely unpopular. 82% of UK consumers expressed that they were uncomfortable or very uncomfortable with the practice and only 10% of consumers expressed any level of comfort. The survey also suggested that there was wide support for the adoption of in-ovo sexing technology, with over three-quarters of consumers agreeing that it should be used to address the challenge of male culling and only 5% of consumers disagreeing.

Latin America

So far there is only one survey on consumer perceptions of chick culling in Latin America. A survey of 500 Chilean consumers, commissioned by the Veg Foundation and run by the multinational market research firm IPSOS found that two-thirds of Chilean respondents agreed that the egg industry should take the initiative to invest in in-ovo sexing technologies without waiting for any legal mandate.