New Survey Shows Strong Business Case for In-Ovo Sexing

Innovate Animal Ag commissioned an original consumer survey showing that there is a strong consumer demand for in-ovo sexing technology, and producers that adopt the technology will find a consumer base ready to pay more for it. The survey consisted of 1,012 U.S. egg buyers, each of whom was responsible for purchasing at least 50% of the groceries for their household. It was fielded by Nielsen Consumer Insights from June 24 to July 2, 2023.

According to the survey:

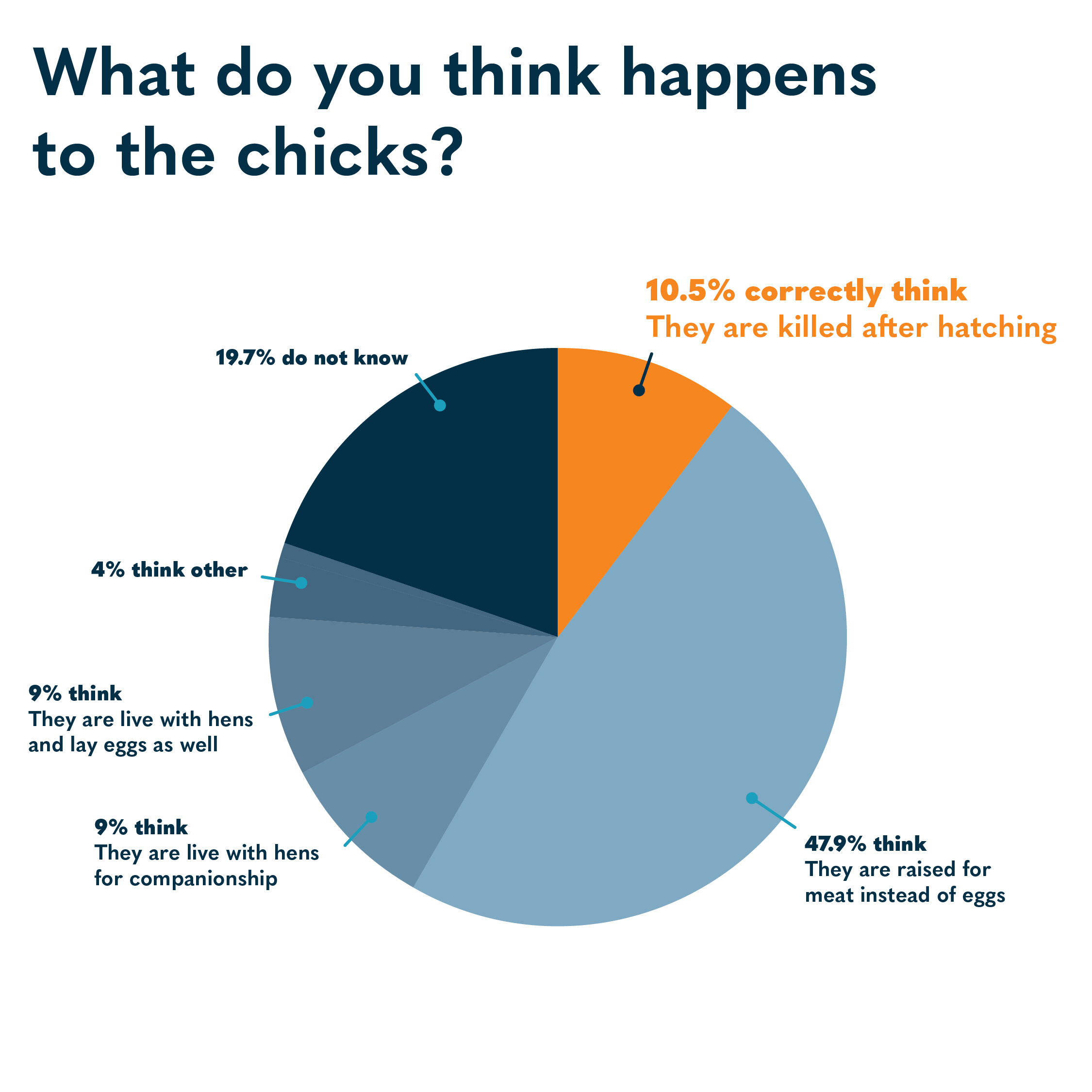

Only 11% of U.S. consumers know about male chick culling; 48% think male chicks are raised for meat.

61% of egg buyers are uncomfortable with the practice of “killing” male chicks while 21% are comfortable; 73% agree the egg industry should find an alternative.

81% of egg buyers are unaware of in-ovo egg sexing technology, but 64% agree the egg industry should adopt it instead of culling male chicks.

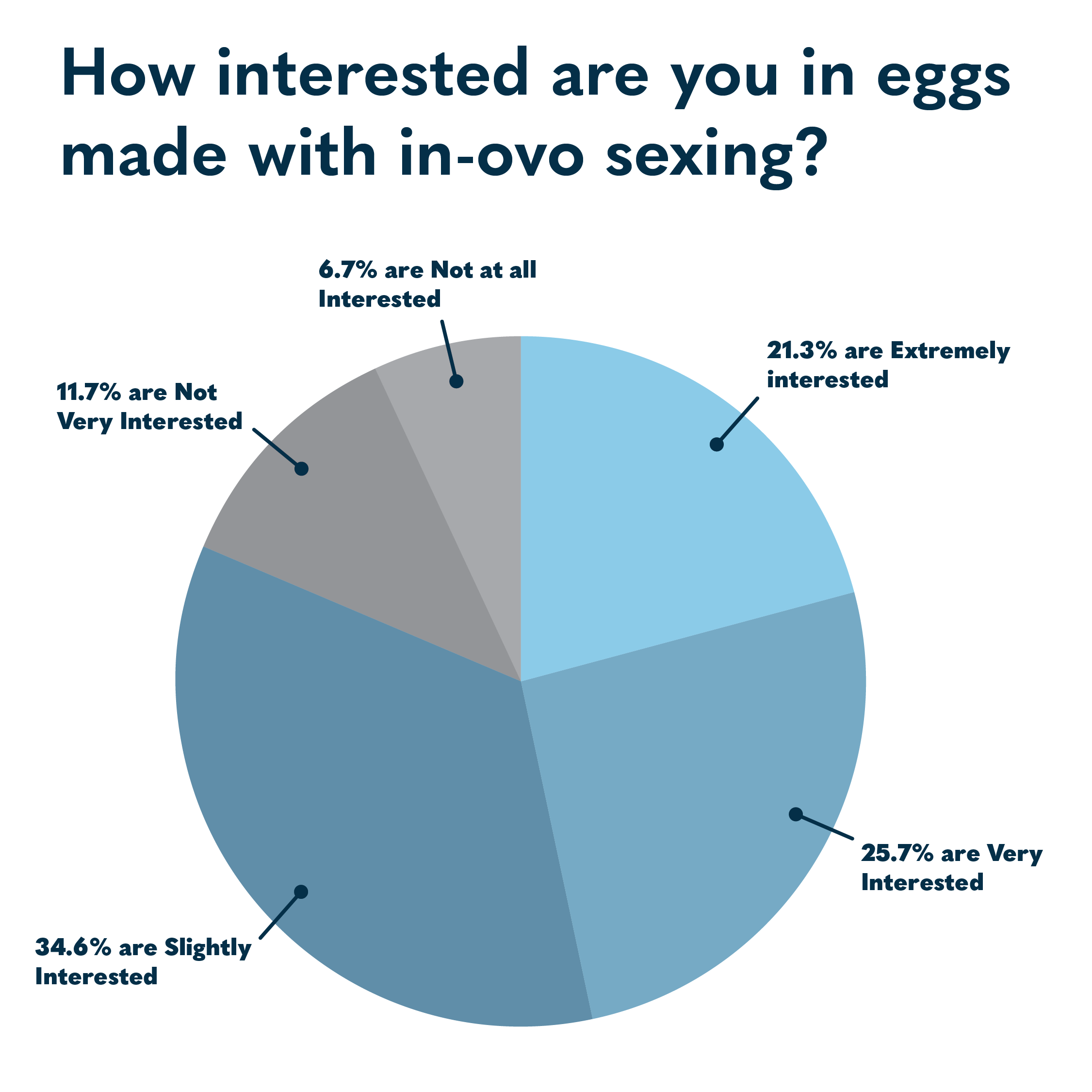

47% of consumers (about 122 million U.S. adults) are “extremely” or “very” interested in eggs produced using in-ovo sexing; another 35% (91 million) are “slightly” interested.

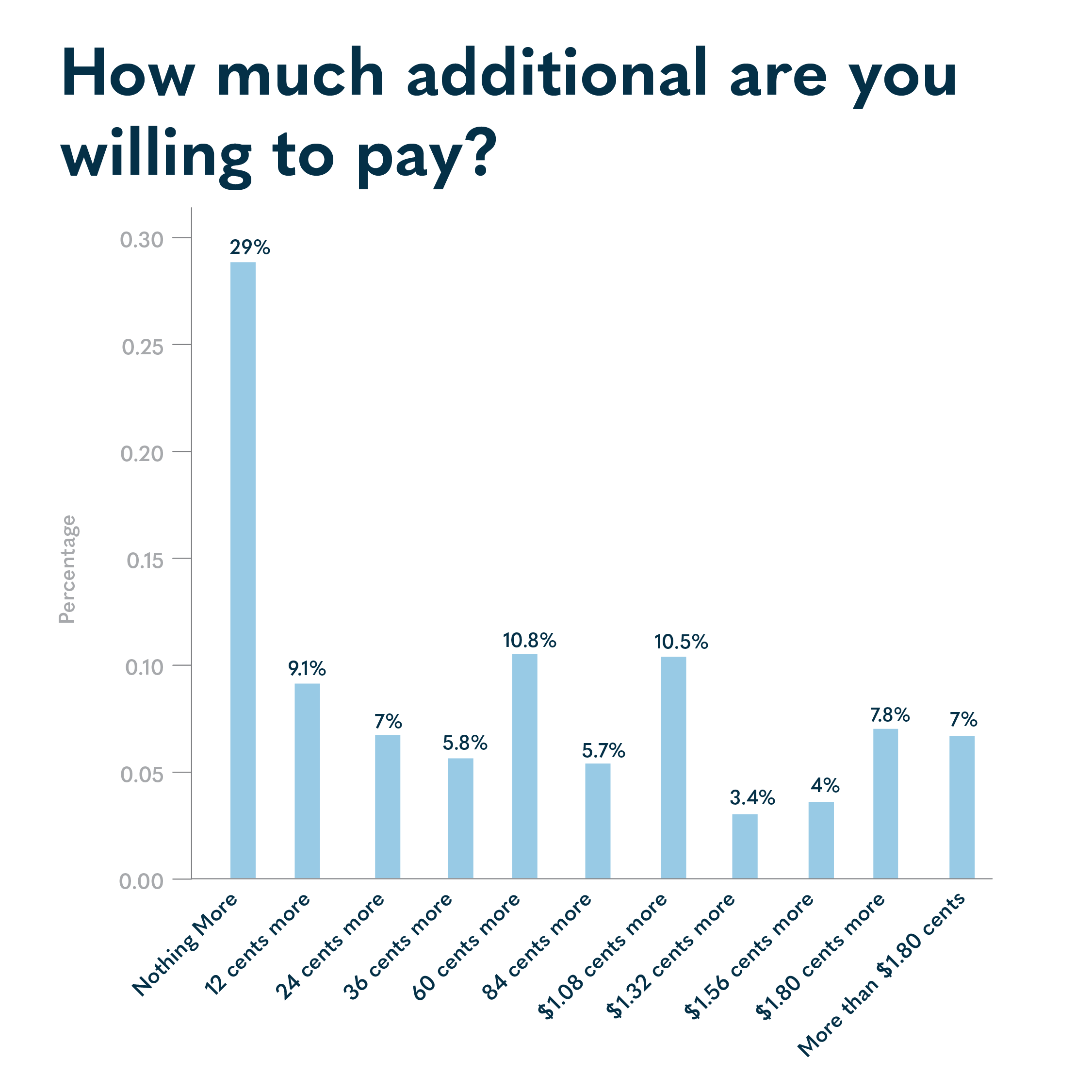

71% of egg buyers are willing to pay a premium for eggs produced using in-ovo sexing. The median willingness to pay was just over 36 cents per dozen, which is the maximum price impact seen in Europe.

The term “no-kill” clearly performed better than other potential terms for in-ovo egg sexing; terms including “cull” fell in the middle and terms including “sex” ranking lowest.

The price impact of in-ovo sexing seen in Europe is 12-36 euro cents per dozen, and the median willingness to pay in this survey was just over 36 cents. This suggests that existing technologies could hit price points that consumers are willing to pay. While willingness-to-pay should be taken with a grain of salt when self-reported, these data suggest a strong business case in the immediate term for eggs made with in-ovo sexing.

The price premium for cage-free eggs in the US fluctuates around $1 per dozen, substantially more than the premium for in-ovo sexing seen in Europe. If eggs made with in-ovo sexing can remain at or below 36 cents per dozen in the US, the strong consumer demand suggests they could be at least as successful in the market as cage-free eggs, which represent 34% of this $10B market.

Producers that implement the technology will be able to pass the increased cost directly to the consumer. Since in-ovo sexing is not yet available in the US, the early adopters will have a strong differentiator, potentially allowing them to charge higher margins and increase their profitability. This survey therefore suggests that there is a large business opportunity for producers that lead the adoption of in-ovo sexing in the US.

For the full report, see here.